Article updated 09/25/2023

We have written about bunching before, so why might now an opportune time to bunch your charitable donations into a Donor Advised Fund (DAF)? Below is a scenario you may want to discuss with your CPA or wealth advisor (or – for CPAs and advisors – an idea you may want to share with your clients):

- Are you approaching retirement? Chances are, your salary in the last five years of your career is about the highest it has ever been. After retirement, your income may significantly decrease which makes charitable contributions less valuable for tax purposes.

- If you are approaching retirement, you may consider bunching donations into a DAF for the next few years. This way, you will take advantage of making large donations while you’re still in a higher tax bracket, and you are essentially saving up the charitable dollars you want to spend during your retirement. This allows you to continue giving to the charities that inspire you without using your retirement income. Plus, in a Donor Advised Fund, your money grows tax-free!

Bunching your charitable donations is a win-win for your taxes and for the charities you donate to regularly. Tax incentives are rarely the only reason you give to charity, but they are always a nice benefit. Bunching your donations with a Donor Advised Fund is mainly a strategy for saving on your taxes (see the year-over-year comparison below), but it also provides the charities you love with stable, consistent income on which they depend.

What is “Bunching”?

“Bunching” is when you combine multiple years of your “normal” charitable donations into a single year. For example, a person who normally gives $10,000 a year to charity would “bunch” two years’ worth of donations into a single year; meaning they would give $20,000 to charity one year and $0 to charity the next.

Why “Bunch” Your Donations?

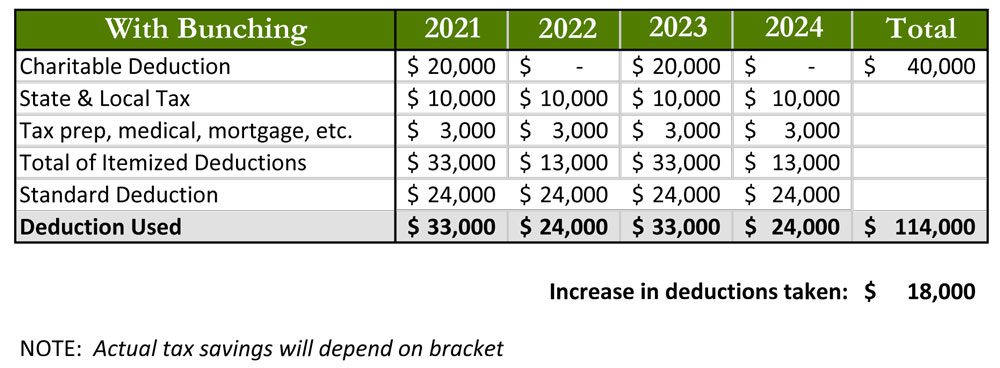

Bunching your donations means that during the year you donate to charity, your charitable deduction combines with other itemized deductions to increase the likelihood of exceeding the standard deduction. Your available tax deduction can actually increase if you use bunching, as you can see in the four-year bunching comparison below.

Bunching Example

To illustrate the tax savings that may occur when a donor utilizes bunching, here is a four-year comparison of the Lee family’s deductions. The Lees give $10,000 to their Donor Advised Fund and distribute that money to the charities they love. They don’t anticipate any major changes in their finances in the next four years, so they are planning to utilize the standard deduction of $24,000, for a total of $96,000 over four years.

The next example shows the Lees bunching their donations to their Donor Advised Fund into two years instead of evenly spread across all four. Everything else stays the same, and they take the standard deduction in the years they don’t donate.

Why “Bunch” Using a Donor Advised Fund?

While simply making all your donations in one year will get you the tax benefit, it can cause volatility in the charities you support. They will receive surpluses and shortfalls in bunching and non-bunching years, making it much more difficult for them to accurately budget and fundraise.

The solution for both taxpayers and charities is a Donor Advised Fund. This allows you to receive the full tax benefit of bunching, but also gives you the time and flexibility to advise grants to multiple charities with no time limit instead of giving in one lump sum. A Donor Advised Fund functions like a “charitable checking account.” You receive the tax deduction when you add money to the fund because that money can only ever be granted to nonprofit organizations. Your money grows tax-free in your fund and you don’t have a time limit for when you need to spend the money.

Why Open a Donor Advised Fund Now?

Now may be the perfect time to open a Donor Advised Fund at the Catholic Community Foundation depending on your personal financial situation. It takes $5,000 to open a DAF and you can advise grants to Catholic and non-Catholic organizations all over the U.S. While our services are similar to commercial DAFs in many ways, the big benefit of opening a DAF at the Foundation is that we are the only local, Catholic partner offering offering personalized, hands-on service to our fund holders. This means we are able to tell you about great programs making an impact in our local community that could use your support. We also invest all our funds using USCCB guidelines and you will know that even the fees you pay on your fund help further Catholic ministry in our community.

Learn more about Donor Advised Funds with the Catholic Community Foundation.