Many provisions of the CARES Act have been extended through 2021 because of the Consolidated Appropriations Act (CAA).

Under the CARES Act there is a lifting of the maximum allowable charitable contribution deduction to 100% of AGI. Limits apply by asset type and donation recipient. We believe a family fund is a high value choice for some families under these provisions.

Are you a CPA, attorney, wealth manager or other professional advisor?

↓ Scroll down for Professional Advisor Resources ↓

Non-Itemizers

Single: $300 above-the-line deduction for cash donations

Couple: $600 above-the-line deduction for cash donations (NEW)

Donation of up to $300 for individuals and $600 for couples will be deducted from adjusted gross income (AGI). This happens before the standard deduction. But, because this deduction is limited to cash contributions, gifts to a donor advised fund and complex gifts of stock or other assets do not qualify for this deduction.

Next Steps

If you likely won’t itemize your tax deductions for 2021, consider a gift to your parish’s endowment or an endowment for another organization you love. See our full list of funds >>

Itemizers

Normally, deduction of charitable contributions range up to 60% of Adjusted Gross Income (AGI), depending on various factors. The CARES Act increases the total for cash contributions for ALL taxpayers up to 100% of AGI with opportunity for including gifts of other assets.

Some previous limits for certain types of gifts/recipients still apply, including:

- The deduction of appreciated assets is capped at 30%

- All current limitations for deductibility of contributions to private foundations still stand

Under the CARES Act, any additional allowable deductions (roughly 40-50% of AGI) must be in cash to a public charity and cannot be directed to a Donor Advised Fund or Supporting Organization.

Next Steps

Consult with your tax advisor to determine an appropriate and effective solution for your unique tax situation.

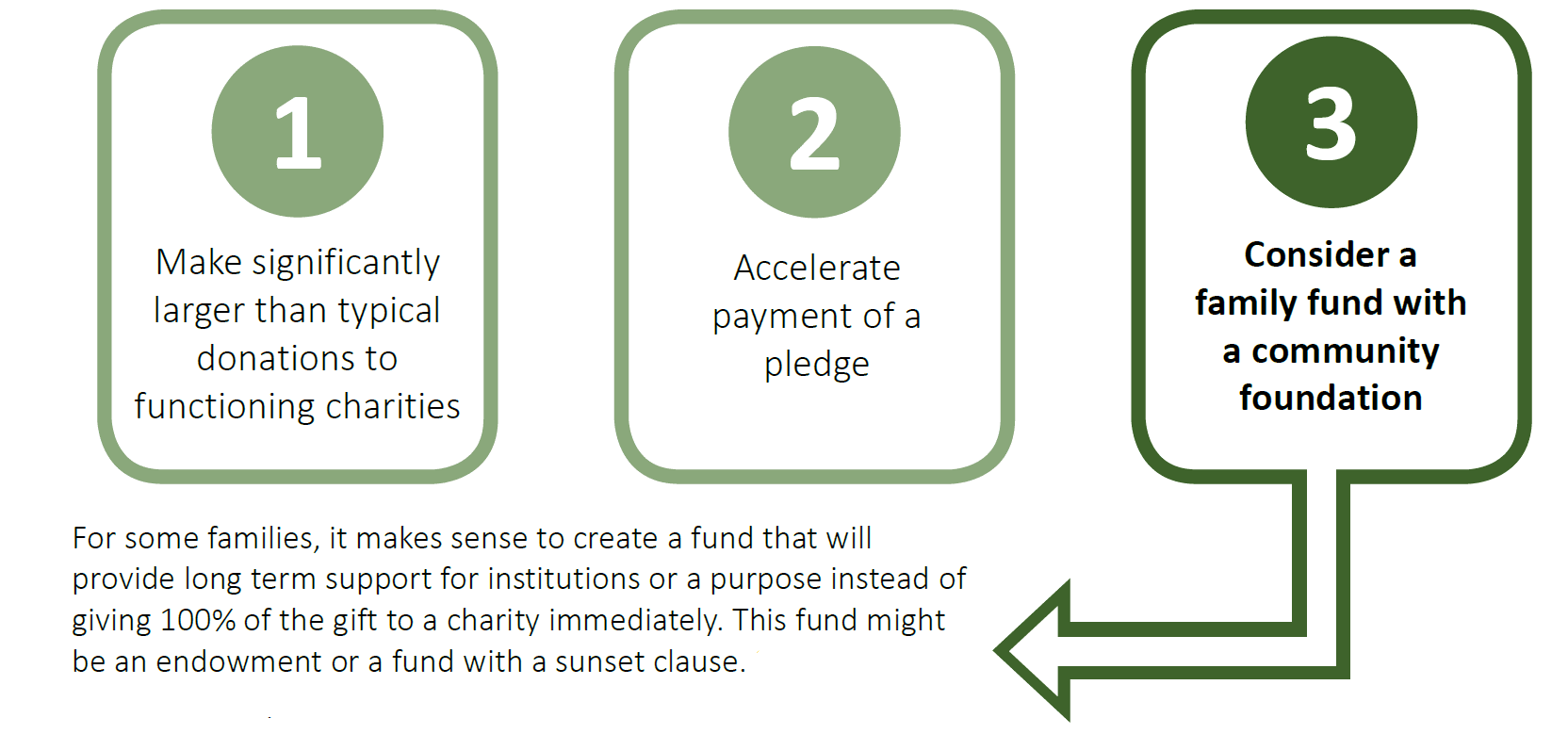

For some, a family fund might be an appropriate solution. Donors who will give large sums but would like their gifts to support the charities they love over a longer period of time (instead of giving a large amount in one lump sum) may consider a custom family fund. This fund might be an endowment, which grants in perpetuity, or a fund with a more immediate granting timeline. There are many different ways to customize these funds, so please contact us to discuss this option. Contact us >>

↓ Read on for more ideas and details for itemizers ↓

Some Options for Taxpayers

Interested in learning more?

Contact us for ideas around creating a fund that will support organizations or programs you love and take advantage of the CARES Act legislation.

Call us at 408.995.5219 or click the contact button below to get in touch with us.

This information is not intended as tax, legal or financial advice. Consult your personal advisors for information specific to your situation.

Resources for Professional Advisors

Are you a CPA, Estate Planning Attorney, Wealth Manager or other type of professional advisor? Does this opportunity sound interesting for your clients? Please see the resources below and reach out to us with any questions or if you would like to discuss.

Recorded Webinar

Recorded Webinar

Watch the recorded webinar where we explore tax implications of the CARES Act and how this legislation creates opportunity for endowment as a solution for fulfilling philanthropic goals. The Catholic Community Foundation was joined by Nancy Moriarty, Tax partner at Frank, Rimerman + Co., who spoke about the provisions of the legislation that impact philanthropy, and Erik Dryburgh, Principal at Adler & Colvin, who discussed endowments, broadly and in light of this legislation. Mary Quilici Aumack, CEO of the Catholic Community Foundation, spoke about family endowments as a unique and effective way that families can take full advantage of this legislation while creating long-term financial support for organizations they love.

Click the link below to view the recording of the webinar. You will need to register in order to view the recording.

Questions? Interested in partnering?

Interested in learning more about what’s possible for yourself or your client?