What is a Family Charitable Legacy Plan?

A Family Charitable Legacy Plan (FCLP) is a simple way to organize and plan your charitable intentions for after your lifetime. It is a set of instructions which the Foundation will follow when we receive your donation via your estate plan.

Through a Family Charitable Legacy Plan, you can do any combination of the following:

- Create a new fund

- Add to an existing fund

- Donate directly to eligible charities

Jump to:

SIMPLICITY

The main benefit of a Family Charitable Legacy Plan is that it significantly simplifies the charitable gifts in your estate plan.

How the Family Charitable Legacy Plan Works

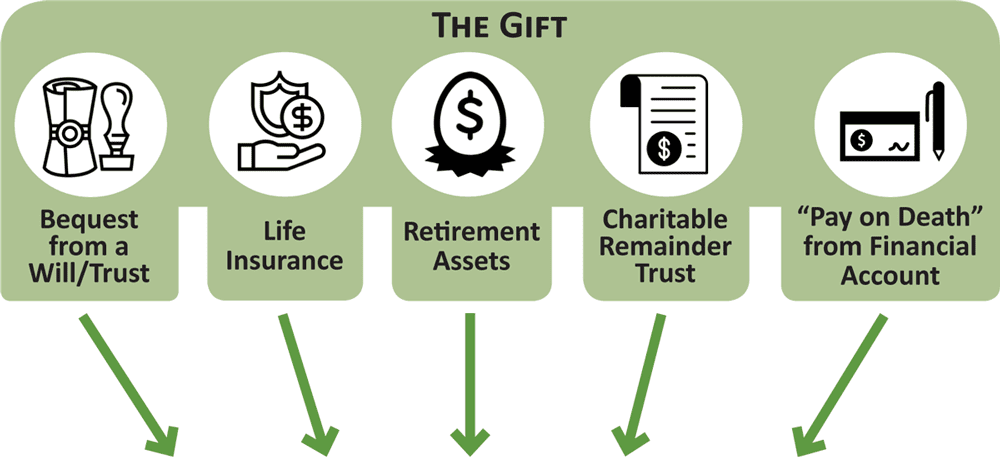

The Gift

The donor decides which assets to leave to charity. The gift could be a simple bequest or a more complex combination of assets. The donor names The Catholic Community Foundation as the beneficiary of the gift(s).

See our Sample Bequest Language for examples of how to name CCF in your trust. For most other assets, naming CCF involves a simple form.

The Beneficiary

Upon the donor’s death, the Foundation receives the gift. From there, the Foundation follows the instructions laid out in the Family Charitable Legacy Plan to fulfill the donor’s wishes.

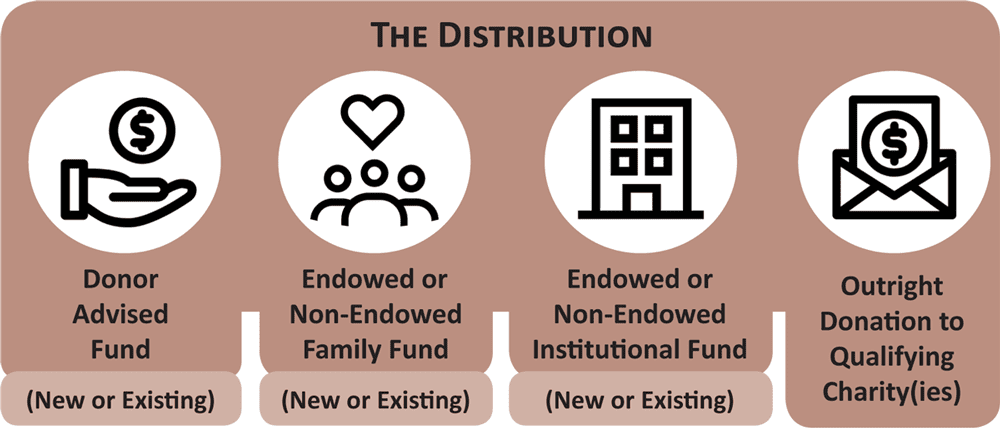

The Distribution

The Foundation distributes the gift according to the donor’s wishes. This may include creating new funds, adding to existing funds, and making donations directly to other charitable organizations.

Click here to learn about all our fund types.

Contact the Foundation at info@catholiccf.org or 408.995.5219 to start the conversation today

Benefits of a Family Charitable Legacy Plan

Single Beneficiary

Instead of naming numerous different charities in your estate plan, simply name the Foundation as the beneficiary of your charitable gift. This way, when you want to change any of the organizations you’ve named, it doesn’t require a visit to your attorney (and the associated fees).

Easy to Update

Unlike your trust and estate documents, a FCLP is easy to modify and doesn’t require an attorney. Simply contact the Foundation to implement changes in your plan. Our friendly and knowledgable staff is happy to assit you.

Contingencies

What happens if an organization you named no longer exists when the gift is realized? What happens if the gift is smaller or larger than you originally anticipated? The Foundation will help you plan for these scenarios.

Guardian of Your Wishes

The Foundation will be the guardian of your charitable wishes after your lifetime. We will honor the plan you outline and ensure that the original intent of your gift is fulfilled.

Simple or Complex Plans

We have the experience to help with all kinds of plans – from very simple to very complex. Whether you leave cash to one beneficiary or donate complex assets like real estate or cryptocurrency to a series of custom funds, we can help you find the best solution to achieve your goals.

Contact the Foundation at info@catholiccf.org or 408.995.5219 to start the conversation today

Family Charitable Legacy Plan Examples

The Le Family Bequest and IRA Gift

The Les decide to leave 5% of the value of their home and the remainder of their IRA to charity after they die. They name the Foundation as the beneficiary of their charitable gifts in their trust and with their IRA provider.

The Les have conversations with the Foundation to determine their goals for their donation and the organizations they want to support.

They decide to use half the money to create a new Family Endowment bearing their name which will support two organizations they love. The other half of the gift will be split – half going to the existing endowment for their parish and half used for one-time donations directly to four different charities.

The Jones Family Plan to Endow their Annual Gift

The Jones Family has supported their parish with an annual gift ever since they became parishioners. They want this support to continue after their lifetime, so they partnered with the Foundation to create the “Jones Family Endowment” which will disburse a 3-5% grant annually for the parish FOREVER.

After the second of them passes away, their estate plan dictates that $100,000 will go to the Foundation to establish the endowment. The plan for this donation is spelled out in their Family Charitable Legacy Plan. This plan gives them comfort because they know that the Foundation will be the guardian of their wishes.

The Gonzales Family Plan to Pass on the Importance of Giving

Being generous is a core value for the Gonzales Family, and they want to be sure that their children and grandchildren inherit the joy of giving. The couple has three children, each with families of their own.

When the couple passes away, a gift from their estate will go to the Catholic Community Foundation to establish three new Donor Advised Funds – one for each of their children. Their children will be able to use these funds to fuel their future philanthropy and continue the tradition of being generous. The couple is already talking to their children about these plans and encouraging them to start the conversation with the next generation.

How to Start Your Family Charitable Legacy Plan

1. Begin by thinking about your goals for your Family Charitable Legacy Plan.

-

- Do you have a list of specific organizations you would like to support?

- Do you have a specific dollar amount you would like to give?

- Do you have a specific type of fund you would like to start/donate to?

2. Reach out to the Foundation. You don’t have to know the answers to every question yet! We will help you by proposing ideas and posing questions.

3. Consult with your professional advisors (estate attorney, CPA, wealth manager, etc.), if appropriate.

4. The Foundation will help you fill out and notarize your Family Charitable Legacy Plan and any other agreements/documents needed to fulfill your plan.

Contact the Foundation any time to start the conversation at 408.995.5219 or info@catholiccf.org