Our Three Main Investment Objectives

1

We focus on long-term investment results in order to provide FOREVER VALUE for the beneficiaries of our funds

2

We pool assets together in order to capitalize on scale, cost, and access to top managers

3

Our investments are screened to ensure compliance with the United States Conference of Catholic Bishops investment guidelines. This is a unique benefit to investing with the Catholic Community Foundation and ensures that your funds will never be invested in organizations or causes that operate counter to our mission.

Investment Summary by Pool

View the summary of investments and returns for the Endowment, Long-Term Growth, Balanced, and Capital Preservation pools. These documents are updated quarterly.

Our Investment Partner

Jordan Park is the investment advisor for the Foundation. Their team of experienced, empathetic and results-oriented managers provides data-driven investment and financial advice for all the Foundation’s funds. Jordan Park’s mission to enhance lives and legacies aligns with the Foundation, working to create FOREVER VALUE for our local Catholic community and to serve community needs.

The Foundation’s Investment Pools

Endowment Growth Pool

GOAL

This pool focuses on the long-term returns and providing FOREVER VALUE for endowment beneficiaries. Return objective between 7% and 8.5% net of estimated investment expenses.

ASSET MIX

The risk profile should mirror a 70% equity 30% fixed income portfolio. Additionally, capturing illiquidity premiums as appropriate creates a target allocation that includes private assets.

Asset Allocation Targets Include:

| Fixed Income | 19% | |

| Public Equities (Derivative Overlay of 16%) | 27% | |

| Semi-Liquid Credit Strategies (Fixed Income Risk) | 7% | |

| Semi-Liquid Equity Strategies (Equity Risk) | 17% | |

| Private Equity | 18% | |

| Private Real Assets (60% Equity, 40% Fixed Income Risk) | 12% |

GRANTING HORIZON

All endowments are invested in this pool with the goal of generating perpetual grants.

Long-Term Growth Pool

GOAL

Long-term growth to enhance the real purchasing power of the portfolio’s assets over a full market cycle. Emphasis on growing funds for long-term needs, while maintaining liquidity/flexibility to respond to the unknown. Return objective around 6% net of estimated investment expenses.

ASSET MIX

Diversified portfolio of stocks, bonds, and alternatives.

GRANTING HORIZON

Utilize for endowments or funds with a grant making time horizon of 7 years or more.

Balanced Pool

GOAL

Balancing growth objective with reduced volatility. Return objective around 5% net of estimated investment expenses.

ASSET MIX

Diversified mix of stocks, bonds, alternatives, and cash.

GRANTING HORIZON

Utilize for conservative funds with a grant making time horizon of 3-7 years.

Capital Preservation

GOAL

Asset preservation and liquidity to meet short-term grant making goals.

ASSET MIX

Cash & equivalents with a small portion in a diversified portfolio of bonds.

GRANTING HORIZON

Utilize for funds with a grant making time horizon of 2 years or less.

Previous Investment Briefings

2024 Investment Briefing Videos

The Catholic Community Foundation partnered with its investment advisor Jordan Park to present an update on the markets, 2023 fund performance and philanthropic trends.

The Catholic Community Foundation partnered with its investment advisor Jordan Park to present an update on the markets, 2023 fund performance and philanthropic trends.

This year’s event comprised of three videos:

- 2023/2024 Market Update by Erin Abouzaid, Senior Vice President, Head of Investment Strategy at Jordan Park

- CCF 2023 Performance by Sean Finigan, CCF Director of Finance and Administration

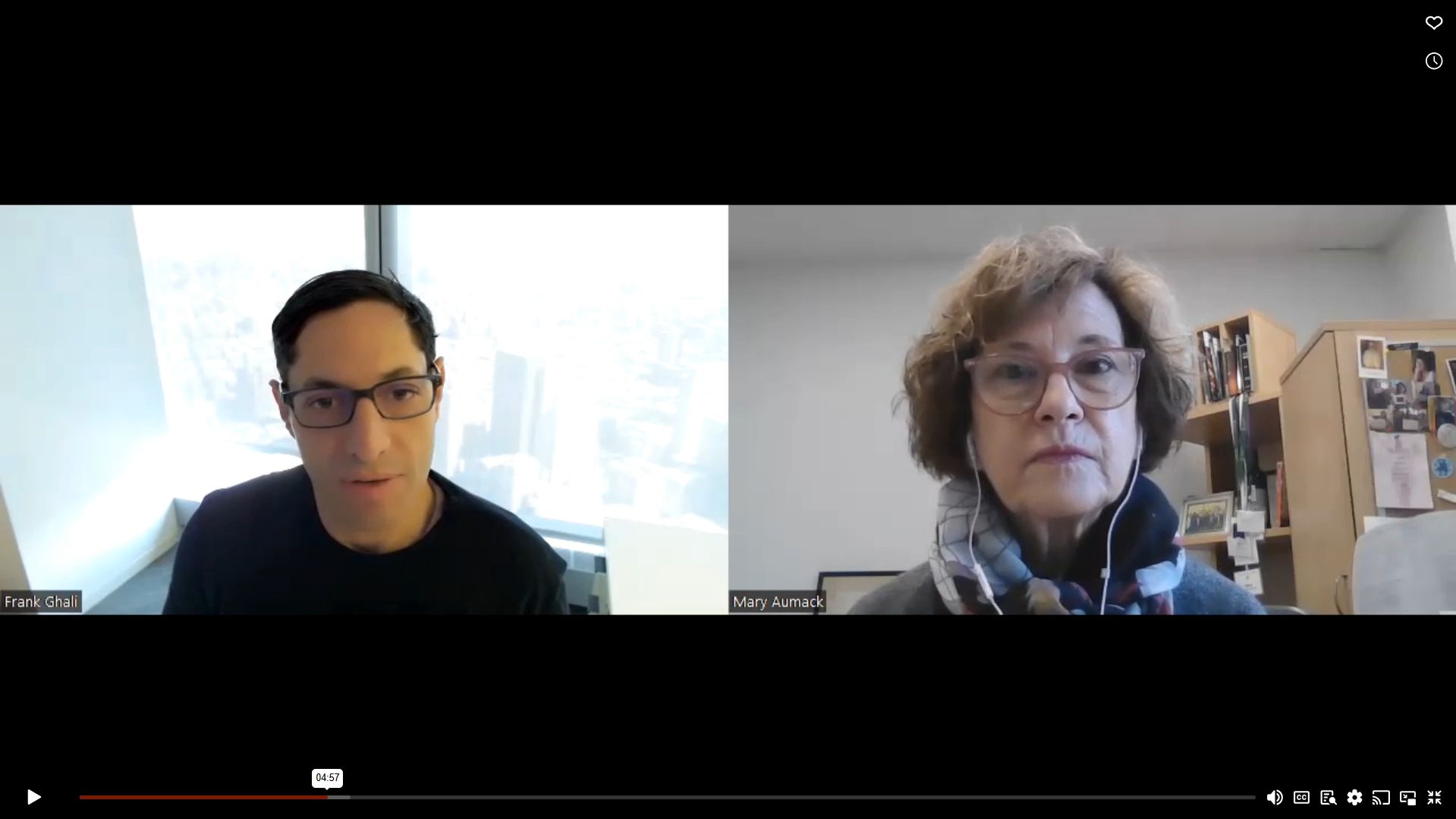

- Trends in Philanthropy by Frank Ghali, Founder & Chief Executive Officer at Jordan Park, and Mary Quilici Aumack, CEO at the Catholic Community Foundation

- 2023 Investment Briefing

- 2022 Investment Briefing

- 2021 Investment Briefing

- 2020 Investment Briefing

- 2018 Investment Briefing

The Catholic Community Foundation partnered with its investment advisor Jordan Park to present an update on 2022 market trends, investment performance, and outlook for 2023.

What You’ll Learn

- Insights from Jordan Park about 2022 market trends and an outlook for the 2023 market

- The Foundation’s investment results for 2022

- Overview of impact investing and trends

- How the Foundation contributes to solutions that improve community

Watch the Recorded 2023 Webinar >

The Catholic Community Foundation, in partnership with its investment advisor Jordan Park, presented an update on investments and a 2022 market outlook on February 28, 2022.

The Catholic Community Foundation, in partnership with its investment advisor Jordan Park, presented an update on investments and a 2022 market outlook on February 28, 2022.

What You’ll Learn

- Insights from our investment advisor about 2021 market performance and a 2022 market outlook

- The Foundation’s goals around impact investing aligning our investments with our Catholic values

- The Foundation’s investment results for 2021

Watch the Recorded 2022 Webinar >

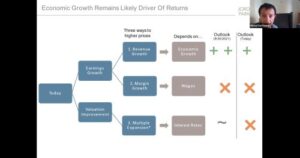

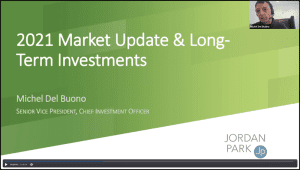

The Catholic Community Foundation in partnership with our investment advisor Jordan Park hosted an investment briefing on February 18, 2021.

The Catholic Community Foundation in partnership with our investment advisor Jordan Park hosted an investment briefing on February 18, 2021.

We presented an update on the current state of the market and long-term investing insights. Topics included:

- Jordan Park’s review of markets and macro-economic conditions in 2020

- Market update and outlook for 2021

- Discussion of the Foundation’s long-term investment strategy

- Why the Foundation is a strong partner for endowment and family funds

- Brief overview of Jordan Park and their mission

Download Webinar Slides >>

On August 18, 2020 the Foundation hosted our Investment Briefing webinar in partnership with our investment advisor, Jordan Park.

On August 18, 2020 the Foundation hosted our Investment Briefing webinar in partnership with our investment advisor, Jordan Park.

Jordan Park gave an update on the market in light of the pandemic. The event also discussed how the volatility in 2020 affected endowments.

View Webinar Slides >>

On June 7, 2018, the Foundation held an Investment Briefing for fund holders. Click the button to view the presentation from this event.

Selected photos from the Foundation’s inaugural Investment Briefing on June 7, 2018 at St. Lucy in Campbell.