By Marie Galetto-Dugoni, Marketing Manager

During a year of significant loss and turmoil, we also witnessed immense generosity. Many people are philanthropic and simply waiting for the right opportunity to give. Such was the case for one donor who is passionate about Catholic education. While already a generous donor, the unique circumstances of the pandemic and the CARES Act legislation in 2020 provided the perfect opportunity to create a highly impactful fund.

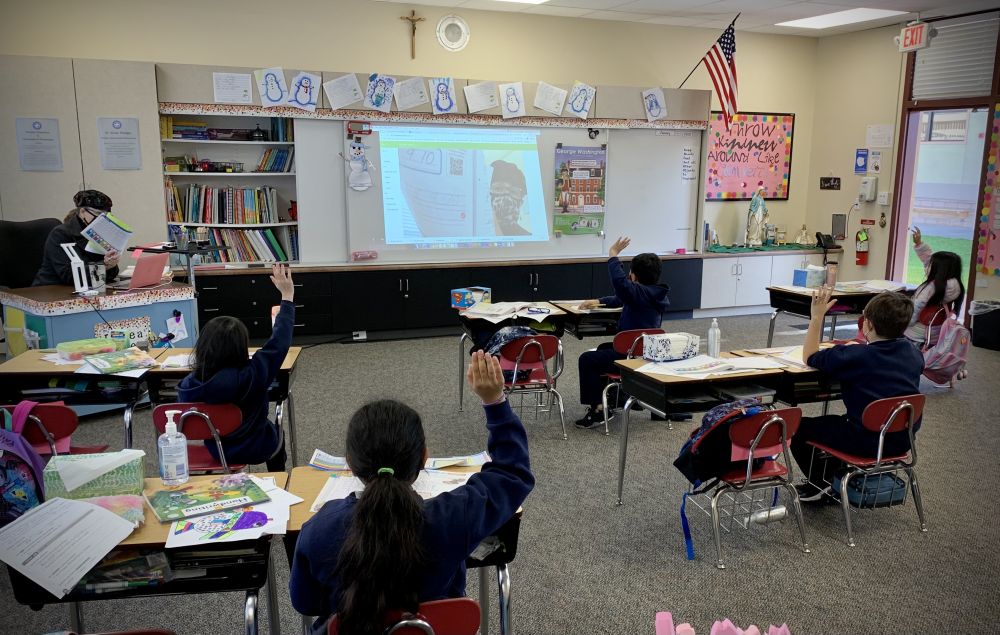

This donor had a vision to enhance the Catholic school experience for low-income students and students in underserved communities by providing services beyond those typically covered by tuition costs. The Foundation worked with the donor and the Diocese of San Jose Department of Catholic Schools to refine this vision into something that would have real and measurable impact. Together we decided that a fund set up to support counseling and intervention services for students and families would fill an existing need and help these students achieve positive outcomes.

“Counseling services are so important for our school children, especially now in the midst of this pandemic. I am really pleased with how the partnership between the Foundation and the Department of Catholic Schools has made this fund stronger.” – Mary Quilici Aumack, CEO, The Catholic Community Foundation

This new fund, entitled the Pillar of Hope Fund for Student Counseling and Intervention Services, will grant $200,000 a year for the next three years to fund a pilot program at three different schools. The Foundation’s knowledge of the CARES Act’s philanthropy provisions helped the donor see why now was the perfect time to start this fund. Under the CARES Act, itemizers are allowed to deduct up to 100% of their Adjusted Gross Income instead of the normal 50%. This is a great opportunity for families that are in a position to increase their giving now and take advantage of the tax benefits.

In addition to our knowledge of the CARES Act, the Foundation also added value in shaping the fund and its parameters. The Foundation already had systems and policies in place to govern, steward, and manage this fund. Based on our experience with similar funds, we were able to help the Department of Catholic Schools and the donor shape an appropriate definition, granting process and reporting requirements for the fund.

Ultimately, it’s the collaboration among the three parties that created this fund and which will continue to bring success to this program for years to come.

The special tax provisions of the CARES Act carried over into 2021. If you are interested in starting a fund for a cause or organization you love, contact us to begin a conversation at 408.995.5219 or info@catholiccf.org