October 1, 2023 – December 31, 2024

INCREASE YOUR IMPACT

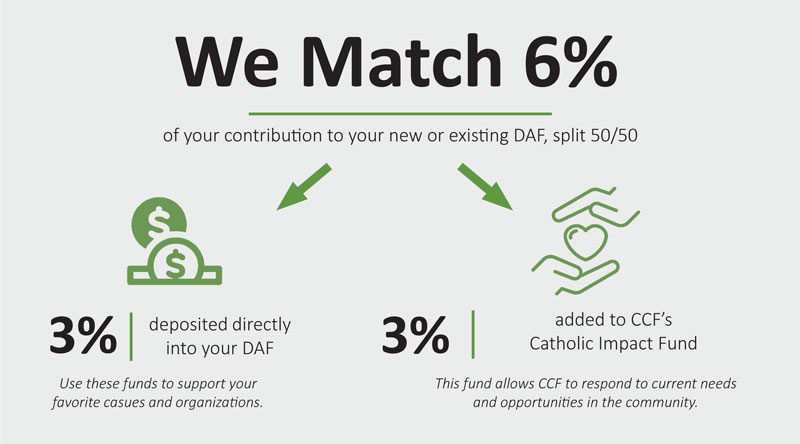

The Foundation is offering an exciting opportunity to extend the reach of your philanthropy. A generous donor has set up a Donor Advised Fund match where you will not only receive matching dollars into your own DAF (which you can grant to charities of your choice), but you will also help the Foundation build our ability to respond to needs and opportunities in our community.

HOW IT WORKS

The Foundation will match 6% of your contribution to your new or existing Donor Advised Fund. This match is split 50/50:

- 3% is deposited directly into your DAF. You can use this money to support charities of your choice.

- 3% is contributed to the Foundation’s Catholic Impact Fund. This fund responds to current needs of our community. The Foundation decides the recipients of periodic grants from this fund. It is meant to be flexible and responsive.

CCF CATHOLIC IMPACT FUND

This non-endowed fund allows the Foundation to respond to current needs and opportunities in our community. Unlike many of our other funds, the fund does not have pre-determined recipients for grants. Rather, this fund is meant to be flexible and responsive to the community. The Foundation’s Board of Directors will strategically select recipients of periodic grants from this fund.

DAF MATCH RULES & RESTRICTIONS

- Available for all new and existing Donor Advised Funds as long as $5,000 minimum is contributed

- Available through December 2024, or, if there is a high volume of interest, while matching dollars last

- $5,000 starting balance required for new funds

- Donations up to $200,000 will be matched 6%. All $200,000 does not need to be contributed at one time

- DAFs will have matching dollars deposited quarterly

- The Donor Advised Fund may not be fully spent within 12 months of receiving the matching money

- Only new dollars will be matched – moving money between DAFs at CCF will not count toward the match

Opening a Fund is Easy!

- Review the Donor Advised Fund Agreement Form

- Fill it out and/or ask us your questions at info@catholiccf.org or 408-995-5219

- Submit the agreement form to the Foundation (we will review your form and help clarify any sections that are confusing)

- We will email you the final version of the agreement for you to e-sign

- Once approved and the initial deposit is received, your fund will be opened and ready for granting

“I highly suggest you set up a Donor Advised Fund with the Catholic Community Foundation. The process of setting up a DAF was easy and the support and guidance the Foundation has provided me is fantastic. It’s nice to be able to donate through an organization that is aligned with the Catholic values of charity and service.”

Interested in Opening a New Fund?

Fill out the form below and the Foundation will reach out to you with next steps and more information.

Contact the Foundation with your questions or for help getting the process started.

info@catholiccf.org | 408-995-5219

DAF FAQs

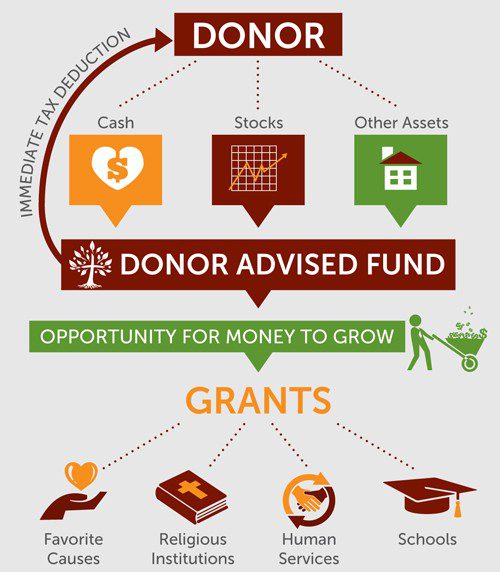

What is a Donor Advised Fund?

Think of a DAF like a charitable checking account. The money you put into the fund can only be granted to non-profit organizations in the United States, but there are no requirements about when or how often you have to grant. Contributions to your DAF are tax-deductible and grow tax-free, increasing your “charitable equity” over time. A DAF may advise grants for up to two lifetimes, creating a legacy of philanthropy within a family.

Why Open a DAF at CCF?

Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission. We connect donors with similar interests to each other and provide educational opportunities to enhance donors’ giving experience and efficacy. As an active grant maker to the community, we are well equipped to advise you about effective local programs and organizations.

What do You Get with a CCF DAF?

- High-touch: Staff is available to assist donors with granting and fund management

- High-tech: Online portal allows grants to be made completely online and access to fund balances, grant history, gift history & database of grantees at any time

- All funds are managed under Catholic guidelines for socially responsible investing. Click here for more about our investments >>

DAF Quick Facts

- Minimum to Open a Fund: $5,000

- Minimum Grant: $250

- Annual Fee: 1%, measured and paid as 0.25% quarterly

- Grant to non-profits across the United States

- May grant to non-Catholic organizations that are aligned with Catholic Social Teaching

We have learned about deserving causes and programs through the helpful communications from the Foundation.

Take Advantage of the Match Opportunity if…

You’ve been interested in opening a DAF but haven’t found the “right time” to do so.

You are looking for a mission-oriented DAF provider who knows the issues and opportunities in the local community.

You want to become more strategic in your giving. A DAF is a great way to start thinking more intentionally about your giving and the Foundation has resources to help you.

You want to get your children more involved in philanthropy.

- For young children, you can have family conversations about where you should direct some of your grants.

- For adult children, consider giving them a DAF for Christmas/their birthday and give them the gift of philanthropy this year.

You already have a DAF with a commercial fund, but you are interested in working with an organization that will partner with you on your philanthropic journey and provide personalized services and recommendations.

You can simply transfer some or all of your existing DAF to the Foundation to open a DAF with us.

You want to bunch multiple years of donations into a single year to take advantage of the standard deduction. Read this article to learn more about bunching.

Opening a fund is simple and may take as little as a few days!

Questions?

Contact the Foundation!

Call: 408.995.5219

Email: info@catholiccf.org