Tax Information

FEIN: 83-0400149

Corporate Number: C2644881

The Catholic Community Foundation

777 N. First St., Suite 490

San Jose, CA 95112

(408) 995-5219

Additional Documents

“3 Things to Know about CCF” for Advisors >

Download Our Fund Agreements:

Sign Up for the Advisor E-Newsletter

Don’t miss the latest updates from the Foundation by signing up for our quarterly email newsletter.

Don’t miss the latest updates from the Foundation by signing up for our quarterly email newsletter.

Ideas for your Clients

"Bunching" with a Donor Advised Fund

Bunching happens when taxpayers “combine multiple years of ‘normal’ annual charitable contributions into a single year.” During the years in which bunching occurs, the charitable deduction combines with other itemized deductions to increase the likelihood of the taxpayer exceeding the standard deduction.

DAFs as part of the Gifting Strategy

As families think about their overall gifting strategy, Donor Advised Funds have come to light as a useful tools.

- Contributing to a DAF is a donation to charity, so it is not subject to gift tax and estate tax limits.

If the gift is made now, it could also provide income tax incentives. - Gifting a DAF to a child/grandchild keeps money “in the family” and encourages charitable giving in the next generations

Simplify Estate Gifts

The Foundation’s Family Charitable Legacy Plan (FCLP) is a simple set of instructions for distributing estate gifts to charity. Utilize our “single beneficiary strategy” so the client names only CCF in the trust/estate documents. The client executes a separate form with us which names all the beneficiaries, contingencies, etc. When your client inevitably wants to make a change, they change only the FCLP document – no need to rework the trust!

Philanthropy Primer

Do you have clients who…

are interested in philanthropy but don’t know how to get started?

want to have a “plan” and be more strategic and intentional with their giving?

The Foundation put together the Philanthropy Primer with questions and conversation starters for clients like those described above. This tool will help your clients begin creating a long-term vision and plan for their philanthropy.

Our Services

Family Funds

Donor Advised Funds >

Donor Advised Funds (DAFs) offer flexibility in your clients’ charitable giving. We provide information about opportunities to meet needs in our community. Your client moves money to a DAF for an immediate tax deduction and then decides later which charities they wish to support.

Family Endowed & Non-Endowed Funds >

Custom Family Funds allow individuals and families to support the organizations and programs that they love, either permanently or with a custom granting timeline. The Foundation provides family name remembrance with grants, protection of intent, variance power for the donor, and more.

These funds are eligible for QCDs from retirement assets.

Legacy Planning Services

Family Charitable Legacy Plan >

We can be your clients’ partner in defining and implementing a charitable gift through their estate plan. We make donating to charity after one’s lifetime simple for both the advisor and the client. Read more about our Family Charitable Legacy Plan to see how our “single beneficiary strategy” works.

Institutional Funds

Designated & Purpose-Driven Funds >

Your clients may donate to an existing fund or create a new fund for a specific organization/program or area of work. These funds are open to donations from the public.

See our full list of Designated & Purpose-Driven Funds here >

Articles for Professional Advisors

Event Highlight: Advisor Networking Night

By Marie Galetto-Dugoni On Monday, February 3, close to 50 professionals gathered in Downtown San Jose to mingle and make connections at the...

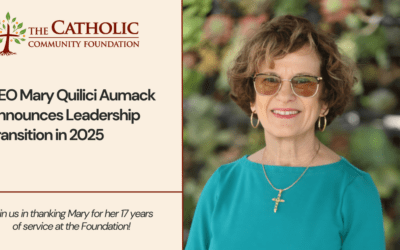

CCF Board Announces Mary Quilici Aumack Will Step Down in 2025

CEO Mary Quilici Aumack announces leadership transition in 2025

Capstone Advisor Session 2024: Three Perspectives on the Charitable Conversation

On October 29, 2024, advisors from around the Bay Area gathered in San Jose to hear about how conversations about philanthropy are impacting the...